Anyone living in Iowa is probably aware that the states budget is in dismal shape, forcing legislators to make some very unpopular funding cuts. Maybe state officials should look into MidAmerican's wind property tax filings to see if they have missed some additional revenue.

There are numerous posts on this blog that cover my concern that the utility's wind project assets may be undervalued. This update lists a few exanples where the utility's county wind property tax filings simply don't match their press releases, their Federal filings at FERC, or their Iowa Utilities board filings. Every one of their county filings I've reviewed so far, lists lower project values than the utility reported for the same project elsewhere. This story plays out in three parts:

1 - Reported project costs.

1 - Reported project costs.

First, let's look at the MEC Lundgren project in Webster County. This press release found online provides the cost of wind VIII, which

Lundgren is a part of .This cost , divided by the number of wind turbines in wind

VIII, results in almost $80,000,000 higher costs than the Utility filed

for property valuations in Webster county

Some of the $1.9 billion will be substation and grid

upgrades, but since those are valued in Webster county at about $12 million,

the numbers clearly are a long way from balancing.

These wind projects will on the tax roles for years ,

and if several million dollars are missing each year…

It is interesting to note that the $80,000,000 higher number

actually is closer to what the Iowa Wind Energy Association estimates the cost ofinstalling wind energy to be.

$1.9 billion divided by 448

total turbines = a value of $4,241,071 per turbine. The utility reported a

value of $3,493,871 for each turbine to Webster County.

MidAmerican also reported a

higher cost to the Federal Energy Regulatory Commission than they listed on

their Webster County valuations, though the values are about $5 million higher

here.

The other MEC wind project

example is the Pomeroy project ,

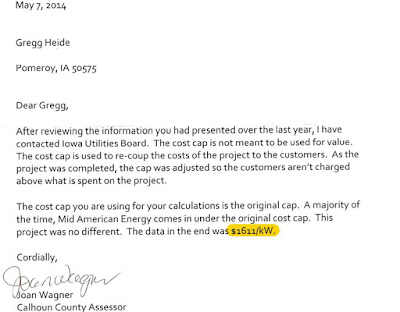

located in Pocahontas and Calhoun counties . I went to the Calhoun county property tax

review board with this concern, and was rejected, but in the rejection

letter , the Assessor actually provided information that showed I was

correct.

The board dismissed my

"protest" "due to lack of standing". Interestingly,

In her letter announcing the review boards decision, The assessor mentions she

contacted the Iowa Utilities Board (IUB), and that the final installed cost of

MidAmerican's wind project in the county was $1611 per kw.

The wind industry frequently

refers to cost figures in $ per kw . In this

case, the turbines are 2.3

megawatt turbines, or 2300 kilowatts. $1611 x

2300 = $ 3,705,300.

MidAmerican's property tax filing to the county was

$3,631,990 total acquisition

cost per turbine, a difference, of $73,310 per turbine. So the assessor is

basically telling me I was right, but dismissing my claim anyway.

$73,310 x the 184 total

number of wind turbines in this project comes to $13,489,040 , and actually the

utility Reported about a $15,000,000 higher project cost at the federal agency

than they reported to the county. Definitely closer the utility's federal filing than its county valuation.

Here are the county

values. (email with county assessors for Pocahontas and Calhoun

counties). This project has been in operation almost 10 years, so we have the

possibility that about $150,000,000 hasn’t been taxed.

Plus, MidAmerican has 20

plus wind projects, and I’m seeing these same discrepancies in every one

I’ve looked at so far.

2- The Utility is listing some wind assets in the Iowa Utility replacement tax instead of reporting them as wind assets under Iowa Code 427B.

More than likely , this lowers

the tax rates on those assets, affecting local government and schools. Neither

DOR or local government has assisted identifying these assets in the utility

replacement tax filings yet, I can compare the assets current tax rate ,

to what the assets would be taxed as if classified as 427.B wind assets.

Also, it seems unfair , as I don’t

think a non-utility owned wind project could use the replacement tax. Below, is an example of this

from the Lundgren wind project in Webster county.

I also have an archived email

from a MidAmerican employee stating this was done at the Pomeroy project

location, so most likely at all their 20 plus wind project locations.

After visiting with DOR about

this, I couldn’t help but wonder if MidAmerican is self-reporting all

their replacement tax filings as well , and what , if any , methods DOR uses to

verify those filings.

The utility later filed this

document, stating the above substation was being transferred to replacement tax

area.

Here is an aerial view of the

2 wind energy substations. The lower substation is the item discussed in the

filings. The filings above indicate that both were constructed to

connect the wind farm to the grid.

Certainly wind related assets

appear to be included in the lower station. This is one instance of wind

property in the replacement tax system.

3 - Iowa Department of Revenue's Property tax division gives clear instructions to county assessors for valuing wind project assets. County assessors don't appear to be following those instructions on the MidAmerican projects I've reviewed.

This 2010 Department of Revenue mail to county

assessors, directs them to be sure all wind plant costs are accounted for.

I met with the Department Of Revenue in 2014, after which ,

their legal department sent me the memo below which pretty well confirms the

2010 directive above . There are several answers to questions from county

assessors here that also support these documents

Yet, Assessors don’t seem to be doing this. The email below

from the Pocahontas County assessor to a wind developer states that usually she

receives a simple cost per turbine letter form the wind project. The

developer below did provide very detailed cost information that supported their

property tax filing . The MidAmerican filings I’ve reviewed often have no

supporting documentation, definitely not as well documented as the Gamaesa

project below. The Gamesa project also appeared to have a higher cost per installed kilowatt (again closer in line to IWEA's estimates) than the Midamerican project in the same county .

The below email from the Calhoun County assessor states that

every county with wind property is assessing the same way.

So, the Department of Revenue gives clear directives how

wind property should be assessed, but county assessors aren’t doing it in my

opinion.

I’ve sent quite a bit of info to the Iowa Department of Revenue and

Department of Management, in addition to county assessors in Webster, Calhoun, and Pocahontas counties, so it will be interesting to see what develops.

here

No comments:

Post a Comment