In my opinion... yes.

I'm going to shift gears slightly from the recent series of posts on the utility's wind asset valuations, and provide some examples of where I believe the utility gets its way too easily from the people responsible for utility over sight.

My first example though... once again... involves wind property taxes.

MEC is currently in the process of re-powering a number of their wind projects in Iowa, with new longer blades, generators, gear boxes, etc, even though some of these projects are only 10 years old.

The utility claims the changes will result in almost 30% more more annual electricity production. Hmm, will MEC increase the annual lease payment to landowners, since the turbines will generate more revenue?

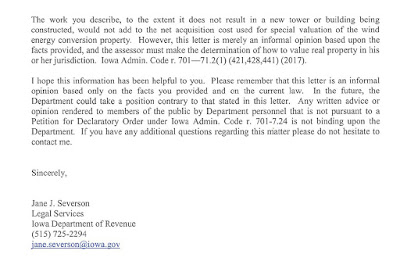

I attended the MEC permitting meeting in Pocahontas county for the re-power of the MEC Pomeroy Project. I inquired how the MEC wind turbine improvements would change the turbine valuations at this project. I was told that the valuations would remain the same, even though MEC is performing a major upgrade. County officials provided me with the following letter from the State Department of Revenue, as reason to leave turbine valuations unchanged.

So, even though the DOR letter states that this is an an informal opinion, and treats the re-power as repairs, instead of the major upgrade that it appears to be, the county seems ready to agree, even though it isn't fair to the county bottom line IMO. I've already documented that the MEC Pomeroy project appears to be undervalued , when local assessor valuations are compared to the MEC's filings at FERC. So, let's look at what's involved in MEC's planned re-power of these projects.

MEC appears to be planning on claiming the federal production tax credit on the re-power, even though this project has already used the federal PTC once. I found an article that states in order for MEC to claim the federal PTC, 80% of each turbine has to replaced.

These are not repairs. MEC is replacing nearly the entire turbine in order to generate more revenue, and claim a tax deduction. MEC doesn't appear to want to share the PTC with ratepayers. (PDF file) The IUB filing states the re-power won't be done unless MEC keeps the PTC themselves. Since the re-power is proceeding , I'm guessing MEC got its way. Interesting to see the heavy hitters opposed to the re-power here though. So, do you think the utility has too much influence on regulators here?

This sure has the look of a tax shelter, and if you search the www for "Warren Buffet tax avoidance", you'll find lot's of entertaining reading.

Then there is this one, where Mr. Buffet claims utilities are only facing competition because of the federal tax credits,for renewables. Really... Berkshire shareholders are buying that one?

This seems to be why Warren appears to like monopolies so much, MEC's competitors are shut out , as this now disappeared article notes . Hmm, maybe I can find a copy on the internet wayback machine.

So, does this state sanctioned monopoly have too much influence in Iowa?

UPDATE

I've found some additional information on the MEC wind turbine re power. The letter above provided by Pocahontas county was the basis for the county's opinion that property taxes would remain unchanged after the re power.

The dept of revenue opinion seems vague here. Does the "tower" refer to the entire wind turbine? What about the "building" ? There would normally be a building at the interconnection point. Maybe DOR means the nacelle when referencing "building". If the letter means the actual tower sections , Surely DOR understands the tower sections are probably the least expensive part of the turbine. MidAmerican is replacing the nacelle, blades,and hubs, almost everything except the tower sections and concrete pad with an upgrade to a larger capacity nacelle,longer blades, and supporting equipment. These are essentially new, larger turbines and should be taxed accordingly IMO. DOR mentions this is only an informal opinion, however.

I find it hard to believe that it's necessary to do this re power given the extra costs involved. I think it's risky to MidAmerican ratepayers. This Utilities Board filing by environmental law and policy center, and the Iowa environmental council (disclosure, I used to serve on the IEC board of directors), supports the re power, noting it will extend the useful life of the wind turbines another 20 years.. I'll bet that MEC pitched the extended turbine life in IUB filings as well. However some of the wind turbines slated for re powering are less than 10 years old.

I found a 2013 IUB filing by MEC stating wind turbines have a useful life of 30 years or even longer, using letters from Siemens and GE stating properly maintained wind turbines have at least a 30 year useful life.. So... the re power only gets the re powered turbines to the original 30 year lifespan? This begs the question - Is MEC not properly maintaining their wind projects? :) I just couldn't resist! However, it raises a more serious question , I do wonder if there is a public record of regulators ensuring the proper maintenance of MidAmerican wind turbines.

So, this seems like an unnecessary endeavor. Local government won't get treated fairly on property taxes IMO. There could additional risk for MEC ratepayers. Yet County officials, the state DOR, IUB and others, have, or seem ready to approve of this. But then, I noted this example of what can happen when a regulator gets on the wrong side of MidAmerican.

Do you think MidAmerican has too much influence over regulators and elected officials? I do.

here