This post contains a number of emails sent to the Iowa Department of Revenue in 2016, documenting a number of discrepancies regarding MidAmerican's wind property tax filings. This first email was also sent to the sent to the Calhoun and Pocahontas county assessors, Chris Vrba at the Pocahontas county Record Democrat, as well as a number of other folks. The other emails were forwarded to a number of folks as well.

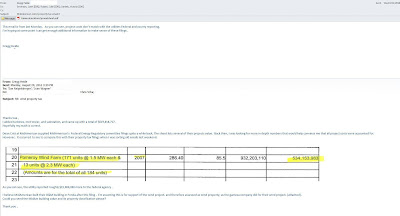

MEC reported to FERC that the Pomeroy wind project had a higher installed cost than the utility reported to the Pocahontas and Calhoun county assessors.

The Iowa code directs wind project owners to report installed costs to county assessors after the project is placed in service. The state department of revenue has also published memos to assessors direct them to verify that all hard and soft costs are accounted for. All the assessors I've checked so far are letting the wind project owners self report and are not ensuring all project costs are accounted for . In fact I've heard an assessor state in a public meeting that she was warned not to contest wind project valuations by the state DOR. I've asked the state DOR to clarify this back in 2014, and received a letter stating assessors should account for all costs. it's not happening yet.

After the state DOR directed me to seek a remedy to wind property concerns through the local property tax review board, I notified the state DOR that didn't receive a fair ruling at the Calhoun county property tax review board.

I notified the state DOR that MEC was declaring some wind property in another tax program.

So, what was the state DOR response ? no reply...crickets chirping.... but, they definitely received them

So, after hearing nothing back from the department of revenue, I reached out to the department of management, who oversee the state budget. The department of management reached out to the department of revenue. I then received an angry call from the DOR property tax department, which I wrote about here.

DOR called me rather than go on the record. My memory of that call ... first , it seemed like they thought I didn't know what I was talking about... then they must of decided I wasn't full of it and the conversation shifted , and they said they weren't going to devote resources to this issue,... and they defiantly wanted to know who at the Iowa utilities board provided some of the information we discussed. The caller was angry, but I guess the flak only gets heavy when you're over the target.

DoR is welcome to respond to the list of questions I sent them in 2017.

So does the utility have too much influence at the state level to look into this? I hope not.

When you visit the DOR website you can find the following info.

Property tax division - mission statement- and it looks like they want to know if the state isn't getting all the revenue it's due.

After the the angry call I received for the state DOR, the state Department of management ceased responding to this issue as well. If you look at their mission, you'd think they would be somewhat concerned about the items I've found.

So why are so many people pushing back against or ignoring this issue. Maybe this post sheds some light on that .

here