Sunday, December 9, 2018

MidAmerican wind property tax

I do have a lot of correspondence on this issue. I thought I would share some of it.

Here, in 2013 , a couple board members at the Iowa Wind Energy Association seem skeptical that MEC was installing wind turbines for the cost I listed in this post at bleedingheartland.

And, if you check my 2014 post, where IWEA discusses installed wind turbine costs, they are higher than MEC was reporting to assessors in 2013 and before. So, MEC is somehow installing turbines at a lower cost than industry numbers reported by the American wind energy association in that time frame ?

In his comment at the end of the bleedingheartland post, IWEA board member Mike Carberry even called it a "financial malfeasance" while wondering if the Des Moines Register would be interested . So far, the Register is not.

Link to the bleedingheartland post.

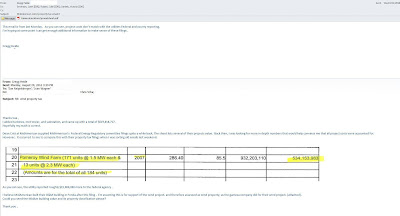

Here's an email discussion with Senator Joe Bolkcom a few months back. I'll post some excerpts. I've known Joe for several years. He seems like a good guy who represents his constituents well. I reached out to him because quotes he made in the media concerning Iowa's budget issues.

Senate Dems were first made aware of this issue when Daryl Beall scheduled a meeting with the DOR property tax department and sent a senate staff person in 2014. Mike Granstal's office was informed also, but I would be happy to meet with them to go over more recent information that I've found. Plus, if people haven't dealt with an issue before, they'll need to learn about it. That's why all those lobbyists hang out at the capital after all :) . Also , yes, my writing skills are not great, and I don't think I always explain this issue well to folks dealing with it for the 1st time.

Really ? Contact the Register? My thinking is any elected official concerned about the budget might want to be involved when someone sends information about discrepancies with $$$ amounts this size, but I did contact Lee Rood as he suggested. Also, I did send some of this information to another DMreg writer a while back, Donelle Eller if memory serves.

Didn't hear anything more from these folks. I did remind Senator Bolkcom about this when I received a Dem email later on fretting over the condition of the states budget, so I've probably annoyed him. Still, I'll gladly meet with senate staff and go over the issue. They will likely be able to obtain documents I've had a hard time getting so far. I'd simply like to hear someone explain why the discrepancies I've identified are occurring .

here

Saturday, December 8, 2018

MidAmerican wind property tax update

updated on 12-9

A timeline of my wind property tax research might be useful to blog visitors.

My research into the MEC wind property tax issue began a few years ago, when I saw a per turbine valuation listed in a local newspaper. I thought the valuations looked too low, as I had some experience with wind project development. When I asked to see MEC's filings in Pocahontas county, I was told they weren't available to the public. Yes, I was denied access to public records. After a lawyer drafted a letter to the Pocahontas county assessor office, The assessor provided the paperwork I had requested. I had the same experience in Calhoun county. A copy of the letter I sent to Pocahontas county previously secured MEC filings in Calhoun as well. I'm not the only taxpayer denied access to these files, but persistence pays off I guess. Did MEC request these records remain confidential?

It soon became apparent that local government had little interest in verifying that the utilities filings were accurate. Daryl Beall was the elected senator for my district at the time. He was kind enough to schedule a meeting with the state property tax department at the Department of of revenue when I informed him about this. He was unable to attend, so he sent a senate staffer (Jace Micheals) with me. The state property tax director had little interest in this issue, and I was directed to the local property tax review board to resolve it. I did file a petition in Calhoun county , which was quickly denied, even though the Calhoun county assessor actually supplied information that supported my suspicion that MidAmericans wind property taxes were too low. It seemed the outcome was predetermined here.

So, from the beginning I got little cooperation from state or local government. I was able to eventually piece together enough information to become convinced that there was a problem here. Much of that information has been uploaded to the blog. including more details on items above. I have more to sort through, and I'm sure there will be more info to come. I worry that this issue is much larger than the discrepancies I've found so far, which is why I called for a thorough audit of MidAmerican's wind property and replacement tax filings in the previous post. The issue looks huge. It's been going on for years. It will take state and local officials lots of time and effort, and no doubt will anger one of the county's largest utilities, which, as this post mentions, can exert a lot of influence in the state. No doubt these are some of the reasons it has been so hard to get public officials interested. Newspapers are probably risking potential advertising income here as well.

So I want to list the public employees and elected officials that have received this information so far. The list will likely be added to as I go back through several years of correspondence on this issue.

The assessors from Calhoun and Pocahontas counties. A Webster county assessor told me the state DOR had warned her against contesting wind property valuations. The following Webster county assessor who replaced her said his hands were tied, and to contact the state DOR and department of management.Supervisors from Webster county and Calhoun county were informed and did not act on the issue.

I fared no better at the state level. DOR sent me back to the local property tax review boards, stating this was a local government issue, so, state and local government are contradicting each other. I finally sent DOR much of the information here on the blog, and received no response. I then contacted the department of management , who in turn contacted DOR. This resulted in an angry unscheduled phone call from DOR property tax department, documented here on the blog. Department of management ceased responding to to me soon after.

Another groups inquiry to the state AG office about MEC's turbine repower project was referred to the DOR, not a good sign considering the experience I had there.

On the Democrat side, former state senator Daryl Beall was very helpful. The information was also sent to Micheal Gronstal's office (Eric Bakker), Senators Joe Bolkcom , and Rob Hogg. who were not interested to date. The state treasurer referred my information to the state auditor ( Republican-who has stated they are looking into this). The state AG office (elected Democrat) referred the turbine repower part to the DOR. Since these discrepancies have been going on for years, the heads of the departments above would have Democrat appointees during part of the time periods I have identified.

They didn't find these problems, or didn't act on them if they did.

an email example sent to Senate Dems, Never did hear back from Eric:

The heads of the state departments above are now staffed by Republican appointees who currently have shown little interest and one even displayed what I would consider strong push back on this issue. The exception being the state auditors office (elected Republican) who said they would review it.

I'm not surprised when someone ignores this, maybe thinking it looks like a lot of work. But I've experienced a lot of bipartisan resistance, along with some genuine push back while trying to sort this out. Add in some off the record comments folks have mentioned, and I'm confident in the need for a large audit.

My current state senator and representative are Republican and I recently met with Senator Kraayenbrink about this. I'm hopeful for their help.

Area newspapers - the Pocahontas Record Democrat and the Storm Lake Times have shown little interest. Lee Rood from the Des Moines register did not respond to information sent to her.

One elected official asked if MidAmerican would ask for a rate increase if it was found the the utility owes more taxes. I suppose it's possible, MEC is a rate regulated utility who gets a guaranteed rate of return . However, if I was a regulator, I'd ask why the utility wasn't reporting taxes accurately in the first place. I'd vote to make the MEC board of directors to cover any back taxes. Fully disclosed tax liability would be crucial for regulators to properly do their job. The last IUB regulator who was critical of MEC was replaced though.

An elected official even revealed during a conversation that he was "told not to look into this" (wish I had a written record of that!) . If he disputes that, he is welcome to roll up his sleeves and assist. And yes, I've endured the jokes about getting audited, or that I'll get beat up from people. Considering that I had one of my letters opened by MidAmerican a few years back .....well .... I always hope for the best with people, though I've got to say this issue has been disappointing at times.

here

And also , anyone listed here is welcome to provide a statement if they disagree with what I've written. Or, they could simply prove me wrong and help sort this out. I'm just a farmer, but I did discover this issue, as opposed to several people above who have the responsibility to make sure things like this don't occur. Anyone of them are welcome to contact me. It would be nice if someone would explain why all these financial discrepancies are happening. This spare time research and reporting project continues....

John Stewart

Thursday, December 6, 2018

MidAmerican wind property tax update

Updated -12-8 , comments added

Almost a year ago, I received a call. Someone had forwarded the MEC wind property tax information I've been making available online to the State Treasurers office. That office in turn had forwarded the information to the state auditors office. The gentleman on the phone mentioned he was from the state auditors office, and had seen the information I've been uploading. He asked some questions , stated the auditors office would be proceeding with a full review that would take a while, and said his office would be in touch at some point. I told him that I would be happy to provide information, relevant correspondence, etc. and thanked him.

As I mentioned above, that's been almost a year ago. I've thought it odd that I've heard nothing since, though I recently noticed the auditors office completed a review started in May of Iowa's medicaid system. It examined several months, January 2017 to November 2018, with 5 staff members performing the review. The article linked here was critical of the audit. The blogger is active in Democrat politics, and the current auditor is Republican, so I won't comment on the politics here, except to note that Iowa has room for improvement on healthcare, lots of room . But, hey , I'm an energy blogger, so I'll keep those opinions to myself for now, except to recommend that visitors who are also interested in healthcare might check out the link to Matt Stoller on the side bar of this blog. I was interested in the time period audited, and time ,staff needed to complete the Medicaid audit because some of the wind property tax discrepancies I've been listing on the blog have been going on more than a decade. Much longer than the review time frame for the medicaid audit.So maybe it isn't odd after all that I haven't heard back from the auditors office.Reviews like this undoubtedly add to their normal annual workload.

I'm hoping the state auditor is still active on this, and will trace down why all the discrepancies and procedures I've listed on the property tax issue have occurred. I still have additional information I haven't uploaded yet. I'm researching and reporting what I've found in my spare time after all. So, here's my wish list for a full and thorough audit into MidAmerican's wind property tax :

1 Audit all of MidAmerican's 20 plus wind projects. Compare the utilities federal FERC wind cost filings and the Iowa utilities board filings , and compare to valuations MEC submitted to county auditors, Every MEC wind project I've looked at so far. has discrepancies between MEC's county filings and the MEC's federal FERC filings, so the auditor should look at all MEC wind projects.The Iowa Utilities board MEC filings relevant to this are likely confidential. The IUB wasn't helpful at all to my inquiry about this. The auditors office would have no trouble getting them. Indeed, the gentleman who called me mentioned he had visited the IUB and would be continuing a review of MEC's wind property taxes. There's probably useful information relevant to this issue at the SEC as well, which I haven't had much time to check into, except to notice some information that MEC filed there that I couldn't find yet at the IUB (transparency issue ?). Some of these wind projects have been in operation for a decade, so that's a lot of wind projects and a lot of years to review.

2 Audit MidAmerican's replacement tax filings at the state department of revenue. Every MidAmerican wind project has listed certain wind project grid connection equipment in the replacement tax program. That information is from an email sent to me by MidAmerican employee Dean Crist. He may possibly be retired. Thanks for your help Dean! That email is posted here on the blog, along with a Webster county MEC filing that supports the email. I've found another wind project that listed similar equipment as wind property. When I review the Iowa code, I don't think MidAmerican should be able to do this. Definitely not fair if DOR is allowing them to and other wind projects in the state can't.

I also noticed MEC removing this equipment from wind property , but I can find no record MEC added it to the replacement tax. Again... 20 plus wind projects, some them more than a decade old, so lots of work here. When I sent DOR information about this, they didn't reply. Then I received an angry call from DOR when I contacted the department of management(the budget folks), and DOM contacted DOR about. During the angry DOR call, they stated that this was not happening. I followed up with an email that I thought clearly showed the wind asset switcheroo was happening. I received reply that stuck to their original position. So... they didn't find this error on their own, or they did know, and were unconcerned ? And, since I found an instance of MidAmerican wind equipment missing from the replacement tax, I suspect that MEC is self reporting their replacement tax to DOR with insufficient oversight. My question about this to DOR has gone unanswered so far.

Since I've found this issue, the auditor should examine MEC's other assets in the replacement tax program for similar problems. Since The annual KWH's of generation are listed at FERC for MEC wind projects, I'm guessing the rest of MidAmerican's assets are there also. State DOR said replacement tax calculation formula was confidential (transparency issue ?) The auditor should compare those generation and transmission assets annual KWH's, calculate the excise tax due on those assets and compare them to the MEC filings for these assets at the department of revenue.I'm guessing there will be discrepancies, and if so, then MEC's natural gas assets should be audited also. The replacement tax program has been in place about 20 years... so, wow! That's a lot to track down. Replacement tax was adopted when the utilities pushed for deregulation in Iowa, noted in another post on this blog.

3 The state auditor should take a position on MidAmerican's current wind turbine repower operation.The state DOR has stated that it considers this operation to be repairs, not improvements.So no additional property taxes will be due . Since MEC is installing bigger gear boxes, larger generators, and longer turbine blades, These sound like improvements, and should be taxed accordingly. The state auditor should sort this out as well. I've also found instances where MEC has lowered the valuations on their wind projects with no supporting documents in county assessor filings. Again... 20 plus wind projects, some in operation over a decade.

I've sent this information to lots of agencies and elected officials, so it was encouraging that one of them called me and said they would be looking into it. As you can see, I'm hoping for a pretty thorough audit, so Iowans can be sure one of the states largest taxpayers is paying its fair share, and treated the same as everyone else. Who knows, maybe the auditor might find some back taxes due to aid the state budget. The discrepancy that I found on just 1 wind project is worth about $120,000 annually,

Also, Iowa will soon have a new State Auditor, Rob Sand, who has stated his intent to exercise use of the auditors office prosecuting and enforcement authority more than the Auditors office has in past years.

There's plenty of other energy issues to write about, but I think I'll stay with the wind property tax issue a while longer. Hope readers aren't getting bored.

Here are some past posts about this issue for easy reference.

emails sent to department of revenue , wind turbine repower, wind turbine repower 2, wind turbine repower 3, mec wind xi, gov removes IUB member after MEC meeting, DOR phone call, utilities board not helpful, non mec owned wind project superior assessor filing, mec press release compared to county assessor filings, mec replacement tax, questions sent to DOR and department of management, mec highland wind project, mec press release 2, mec lundgren wind project, mec wind press release vs county filings, Iowa wind energy association cost estimates, Calhoun county MEC wind property tax review, DOR wind cost reporting memo to assessors, mec wind Pocahontas county, mec wind Calhoun county, mec dean crist, auditors office, and more posts, though these have the bulk of the information found..

here

Sunday, September 23, 2018

MidAmerican wind property tax update

This post contains a number of emails sent to the Iowa Department of Revenue in 2016, documenting a number of discrepancies regarding MidAmerican's wind property tax filings. This first email was also sent to the sent to the Calhoun and Pocahontas county assessors, Chris Vrba at the Pocahontas county Record Democrat, as well as a number of other folks. The other emails were forwarded to a number of folks as well.

MEC reported to FERC that the Pomeroy wind project had a higher installed cost than the utility reported to the Pocahontas and Calhoun county assessors.

The Iowa code directs wind project owners to report installed costs to county assessors after the project is placed in service. The state department of revenue has also published memos to assessors direct them to verify that all hard and soft costs are accounted for. All the assessors I've checked so far are letting the wind project owners self report and are not ensuring all project costs are accounted for . In fact I've heard an assessor state in a public meeting that she was warned not to contest wind project valuations by the state DOR. I've asked the state DOR to clarify this back in 2014, and received a letter stating assessors should account for all costs. it's not happening yet.

After the state DOR directed me to seek a remedy to wind property concerns through the local property tax review board, I notified the state DOR that didn't receive a fair ruling at the Calhoun county property tax review board.

I notified the state DOR that MEC was declaring some wind property in another tax program.

So, what was the state DOR response ? no reply...crickets chirping.... but, they definitely received them

So, after hearing nothing back from the department of revenue, I reached out to the department of management, who oversee the state budget. The department of management reached out to the department of revenue. I then received an angry call from the DOR property tax department, which I wrote about here.

DOR called me rather than go on the record. My memory of that call ... first , it seemed like they thought I didn't know what I was talking about... then they must of decided I wasn't full of it and the conversation shifted , and they said they weren't going to devote resources to this issue,... and they defiantly wanted to know who at the Iowa utilities board provided some of the information we discussed. The caller was angry, but I guess the flak only gets heavy when you're over the target.

DoR is welcome to respond to the list of questions I sent them in 2017.

So does the utility have too much influence at the state level to look into this? I hope not.

When you visit the DOR website you can find the following info.

Property tax division - mission statement- and it looks like they want to know if the state isn't getting all the revenue it's due.

After the the angry call I received for the state DOR, the state Department of management ceased responding to this issue as well. If you look at their mission, you'd think they would be somewhat concerned about the items I've found.

So why are so many people pushing back against or ignoring this issue. Maybe this post sheds some light on that .

here

Sunday, September 9, 2018

MidAmerican wind property taxes update

There's some news again on the MidAmerican wind turbine re power plan. people in the area are rightly concerned that counties may not receive any additional property tax revenue as a result of this large improvement.

First, I think it's useful to recap some of the MEC wind property tax information I uploaded to the blog over the last several months, and see how it is related to the current re power issue. I'd recommend that interested readers first review my previous post for some additional insight.

I contacted my district state senator, Daryl Beall, in 2014 about my concerns with MidAmerican wind project valuations being too low . Senator Beall promptly scheduled a meeting with Julie Roisen at the department of revenue property tax division . Mr. Beall was unable to attend so a senate staff person and myself attended the meeting together. We met with Ms.. Roisen and a staff person. I got the distinct impression that the department of revenue thought I was wasting their time at this meeting. It was explained to me that wind property was locally assessed, and that DOR only issued advice on how to perform that task. If I was worried about wind property valuations, I was directed by DOR to use the local property tax review board, and DOR explained that process along with the state appeal process. They also provided me with a letter from their legal adviser, that seemed to once again direct county assessors to fully account for all wind project costs. It is posted on this blog.

Afterwards, I wrote a thank you letter which recapped my understanding of what was discussed at the meeting. DOR has never disagreed. I've since updated the undervaluation number in the email to $150 million , and MidAmerican now has more than 20 wind projects. I also sent additional information to DOR in 2016,and hearing nothing back reached out to the Department of Management in 2017. DOR called me soon after that, stating they were not going to devote resources to this issue, but mainly, it amounted to chewing me out for a half an hour. Here's the 2014 DOR email.

I then followed DOR advice and asked the Calhoun county property tax review board to look into my concerns the MidAmerican's wind property was undervalued . I met with the review board. Later, the Calhoun assessor sent a letter that denied my "protest" , but included information that basically said I was right. That information is here.

So to recap,

Every MidAmerican wind project I've checked so far shows lower valuations at the county level than MEC has stated at the federal level, in MEC press releases, and some information I was able to review at the Iowa utilities board.

MEC is placing property in the Iowa utility replacement tax that meets the definition of wind property when the wind code is reviewed IMO. DOR says that is not happening. I've got an email from a MidAmerican employee that says it is. Pocahontas county has 2 large wind projects. The one not owned by MEC declared similar property to the MEC replacement tax items as wind property.

The replacement tax issues leads to a much bigger concern. state officials and local officials had not noticed the replacement tax problem, and I've found an example of MEC wind property that was never added to replacement tax rolls as MEC has stated. Since Iowa utilities pay most of their state taxes through the replacement tax system... Well.... MEC replacement tax filings need a proper audit IMO, probably several years worth.

So there is some precedent to resolving wind property valuations locally, That's what I was told to do. For the folks currently worried about the wind re power issue, I'd recommend they try to resolve this locally. However, the Pocahontas record Democrat reports that after noting it may be some time before the state AG office looked into the wind re power issue, AG promptly replied, and encouraged BV and Pocahontas county to request a formal opinion on this issue from. DOR.

State AG also mentioned using the existing local property tax review and appeal process. I haven't seen the AG letter. Hopefully I can get a copy.

I noted in the previous post that I was concerned about a potential state AG office conflict of interest. Now the AG has referred this matter to the department that so far is declining to look into potential lost revenue that I've listed on this blog, and who has already wrote an opinion unfavorable to counties on the re power issue.

The counties should try to solve this locally before ceding their authority to the state level, and risking an unfavorable ruling. Whatever the outcome, county assessors seem to think they can't assess wind property unless the wind project owners do it for them.. even though a lot of DOR memos seem to say otherwise. It concerns me when all this is said and done, that MEC will still self report their wind valuations to county assessors, when I've listed a number of examples that seem to point out that MEC shouldn't be allowed to do that. A Webster county supervisor mentioned they sometimes retain 3rd party consultants to make sure industrial property tax filings are accurate, seems like that would work for wind property. More precedent for resolving this locally IMO. And if MEC is self reporting their replacement tax filings, that shouldn't be allowed either

I'll be uploading the emails that I sent to DOR on this issue soon.

here

First, I think it's useful to recap some of the MEC wind property tax information I uploaded to the blog over the last several months, and see how it is related to the current re power issue. I'd recommend that interested readers first review my previous post for some additional insight.

I contacted my district state senator, Daryl Beall, in 2014 about my concerns with MidAmerican wind project valuations being too low . Senator Beall promptly scheduled a meeting with Julie Roisen at the department of revenue property tax division . Mr. Beall was unable to attend so a senate staff person and myself attended the meeting together. We met with Ms.. Roisen and a staff person. I got the distinct impression that the department of revenue thought I was wasting their time at this meeting. It was explained to me that wind property was locally assessed, and that DOR only issued advice on how to perform that task. If I was worried about wind property valuations, I was directed by DOR to use the local property tax review board, and DOR explained that process along with the state appeal process. They also provided me with a letter from their legal adviser, that seemed to once again direct county assessors to fully account for all wind project costs. It is posted on this blog.

Afterwards, I wrote a thank you letter which recapped my understanding of what was discussed at the meeting. DOR has never disagreed. I've since updated the undervaluation number in the email to $150 million , and MidAmerican now has more than 20 wind projects. I also sent additional information to DOR in 2016,and hearing nothing back reached out to the Department of Management in 2017. DOR called me soon after that, stating they were not going to devote resources to this issue, but mainly, it amounted to chewing me out for a half an hour. Here's the 2014 DOR email.

I then followed DOR advice and asked the Calhoun county property tax review board to look into my concerns the MidAmerican's wind property was undervalued . I met with the review board. Later, the Calhoun assessor sent a letter that denied my "protest" , but included information that basically said I was right. That information is here.

So to recap,

Every MidAmerican wind project I've checked so far shows lower valuations at the county level than MEC has stated at the federal level, in MEC press releases, and some information I was able to review at the Iowa utilities board.

MEC is placing property in the Iowa utility replacement tax that meets the definition of wind property when the wind code is reviewed IMO. DOR says that is not happening. I've got an email from a MidAmerican employee that says it is. Pocahontas county has 2 large wind projects. The one not owned by MEC declared similar property to the MEC replacement tax items as wind property.

The replacement tax issues leads to a much bigger concern. state officials and local officials had not noticed the replacement tax problem, and I've found an example of MEC wind property that was never added to replacement tax rolls as MEC has stated. Since Iowa utilities pay most of their state taxes through the replacement tax system... Well.... MEC replacement tax filings need a proper audit IMO, probably several years worth.

So there is some precedent to resolving wind property valuations locally, That's what I was told to do. For the folks currently worried about the wind re power issue, I'd recommend they try to resolve this locally. However, the Pocahontas record Democrat reports that after noting it may be some time before the state AG office looked into the wind re power issue, AG promptly replied, and encouraged BV and Pocahontas county to request a formal opinion on this issue from. DOR.

State AG also mentioned using the existing local property tax review and appeal process. I haven't seen the AG letter. Hopefully I can get a copy.

I noted in the previous post that I was concerned about a potential state AG office conflict of interest. Now the AG has referred this matter to the department that so far is declining to look into potential lost revenue that I've listed on this blog, and who has already wrote an opinion unfavorable to counties on the re power issue.

The counties should try to solve this locally before ceding their authority to the state level, and risking an unfavorable ruling. Whatever the outcome, county assessors seem to think they can't assess wind property unless the wind project owners do it for them.. even though a lot of DOR memos seem to say otherwise. It concerns me when all this is said and done, that MEC will still self report their wind valuations to county assessors, when I've listed a number of examples that seem to point out that MEC shouldn't be allowed to do that. A Webster county supervisor mentioned they sometimes retain 3rd party consultants to make sure industrial property tax filings are accurate, seems like that would work for wind property. More precedent for resolving this locally IMO. And if MEC is self reporting their replacement tax filings, that shouldn't be allowed either

I'll be uploading the emails that I sent to DOR on this issue soon.

Wednesday, August 29, 2018

MidAmerican Wind Repower

MidAmerican is re powering wind turbines at numerous sites in Iowa. I've written numerous posts here asking why MEC property tax filings to county assessors. are lower than the utility has reported elsewhere, including FERC, the IUB,and in their own press releases.

I also threw in my 2 cents about the re power back in May , after voicing concerns at a Feb. zoning meeting in Pocahontas county concerning an MEC planned re power there. Not only do the current property valuations appear too low on this project, as I've noted in this post, but county officials have explained there will be no property tax increase as a result of the re power improvement. I asked the county to request that the property tax discrepancies I've found on this project be resolved before permitting was approved. That might not be traditionally germane to the permitting process, but I certainly thought it was reasonable to ask. Especially now that a major improvement was planned with no tax benefit. The county declined to do that.

MEC changed their re power plans for this project , apparently now MEC also intends to re power turbines installed in 2011 as well , despite telling the IUB that properly maintained wind turbines can generate electricity for 25 years or more. This change required MEC to modify their permit application , and another zoning meeting was held on August 13. I attended this meeting as well, and repeated my Feb concerns about the wind projects tax valuations , including noting the re power should be treated as an improvement. The county again approved the project without cleaning up the tax issues.

Several MEC employees were in attendance and one of them agreed to get me information I requested the county officials to look into. It was Adam Jablonski, and he did call a couple days later, leaving a voicemail stating he was hoping to discuss this to make sure he understood my concerns-better understand them ... something to that effect, and that he would be setting up a call with the MEC tax department. . My call back went to voicemail as well, I left my email address, noted I had a small list questions, and that I thought it would be more efficient for all to sort things out by email. I'm still waiting several weeks later.!

I hear the re power with no additional tax revenue issue getting some discussion in the area, so it was nice to see it addressed in the Pocahontas Record Democrat by Chis Vrba. Chris noted a cost estimate for the re power at this site of $256 million. The article also noted a BV county area attorney had contacted the state AG office in April asking for a ruling if the improvements at wind projects in Buena Vista and Pocahontas counties should be taxed as such. the article also noted a familiar line from 2 county assessors stating they can't raise taxes unless the wind projects report the costs to them. The article is not available online, but I'll add it if I get permission. Chris and the people quoted in the article are welcome to provide a statement as well. Let's look at these three items I noted from this article.I'd also encourage interested folks to pick up a copy or subscribe to the paper.

First, the $256 Million re power.

Yes folks , almost a half $billion dollars not taxed or improperly taxed. MEC has over 20 more wind projects I believe, and I'm seeing theses same issues at other projects.

Next, asking the state AG office for a ruling on this.

The office of consumer advocate is part of the AG office, and it seems they would be naturally be concerned that any increase in local wind property taxes would cause MEC to ask for a electric customer rate increase, and oppose a property tax increase. In fact, I've had a public official tell me that OCA would likely do just that.

I'm not an attorney, so the gentlemen that asked the AG office for an opinion may very well have considered that. The AG office might also have guidelines in place for when such situations arise. Never the less, it looks like a potential conflict of interest IMO. And the AG office took several months to get back to the area inquiry stating they weren't sure when they would look into this. I would think a statement from the AG office describing the various AG office responsibilities here would have been included in any reply.

At any rate, AG joins the state department of revenue, department of management, Iowa utilities board, local assessors, and numerous public officials in being not helpful with sorting this out so far...

And finally, the BV county and Pocahontas county assessors stating they can't increase wind property taxes unless the utility reports the costs.

I've read numerous department of revenue memos, directing assessors to account for all wind project costs, and I've listed enough examples on this blog to determine that in my opinion, that's not happening , I see nothing in the wind statute that prevents them from tracing down these discrepancies, or increasing property taxes as a result of the re power. Assessors are welcome to go on record here, or provide the specific part of the code that prevents them from doing this. I'll also note that the Calhoun county assessor verbally told me that all county assessors are using the same methods to value wind property as Buena Vista county, as that county had one of the first large wind projects in the state. An email from her stating that all counties are assessing wind properties the same way is posted on this blog .

Wind property is assessed locally, and this is a departure from how assessors treat other property owners who make improvements , and, a clear county and state appeal process exists for property owners who disagree with property assessments. In fact Calhoun county has already handled a contested wind property review, and ruled improperly in my opinion.

So the property tax issues I've been reporting have become an even bigger mess.

stay tuned.

here

I also threw in my 2 cents about the re power back in May , after voicing concerns at a Feb. zoning meeting in Pocahontas county concerning an MEC planned re power there. Not only do the current property valuations appear too low on this project, as I've noted in this post, but county officials have explained there will be no property tax increase as a result of the re power improvement. I asked the county to request that the property tax discrepancies I've found on this project be resolved before permitting was approved. That might not be traditionally germane to the permitting process, but I certainly thought it was reasonable to ask. Especially now that a major improvement was planned with no tax benefit. The county declined to do that.

MEC changed their re power plans for this project , apparently now MEC also intends to re power turbines installed in 2011 as well , despite telling the IUB that properly maintained wind turbines can generate electricity for 25 years or more. This change required MEC to modify their permit application , and another zoning meeting was held on August 13. I attended this meeting as well, and repeated my Feb concerns about the wind projects tax valuations , including noting the re power should be treated as an improvement. The county again approved the project without cleaning up the tax issues.

Several MEC employees were in attendance and one of them agreed to get me information I requested the county officials to look into. It was Adam Jablonski, and he did call a couple days later, leaving a voicemail stating he was hoping to discuss this to make sure he understood my concerns-better understand them ... something to that effect, and that he would be setting up a call with the MEC tax department. . My call back went to voicemail as well, I left my email address, noted I had a small list questions, and that I thought it would be more efficient for all to sort things out by email. I'm still waiting several weeks later.!

I hear the re power with no additional tax revenue issue getting some discussion in the area, so it was nice to see it addressed in the Pocahontas Record Democrat by Chis Vrba. Chris noted a cost estimate for the re power at this site of $256 million. The article also noted a BV county area attorney had contacted the state AG office in April asking for a ruling if the improvements at wind projects in Buena Vista and Pocahontas counties should be taxed as such. the article also noted a familiar line from 2 county assessors stating they can't raise taxes unless the wind projects report the costs to them. The article is not available online, but I'll add it if I get permission. Chris and the people quoted in the article are welcome to provide a statement as well. Let's look at these three items I noted from this article.I'd also encourage interested folks to pick up a copy or subscribe to the paper.

First, the $256 Million re power.

$256 million is a lot of upgrade …it’s not a repair .What are

the cost of the new components compared to the old?

I've previously noted the following issues at this project.

MEC listed a higher cost at IUB and federally … about $15

Million, for this project

Wind project operational for 10 years , so $150 million

currently not taxed now.

MEC has wind assets in the replacement tax (the

wrong Program) instead of listing them as wind property.Another wind project in the county lists the same equipment as wind property.

Webster county example of this listed the equipment at about

$3 million, so $30 million has been improperly tax taxed for 10

years in Pocahontas, If it’s taxed at all . I find no record of this asset

added to the replacement tax assets in Webster county.

So the items I’ve found are nearly as large a $$$ amount as the

re power.Yes folks , almost a half $billion dollars not taxed or improperly taxed. MEC has over 20 more wind projects I believe, and I'm seeing theses same issues at other projects.

Next, asking the state AG office for a ruling on this.

The office of consumer advocate is part of the AG office, and it seems they would be naturally be concerned that any increase in local wind property taxes would cause MEC to ask for a electric customer rate increase, and oppose a property tax increase. In fact, I've had a public official tell me that OCA would likely do just that.

I'm not an attorney, so the gentlemen that asked the AG office for an opinion may very well have considered that. The AG office might also have guidelines in place for when such situations arise. Never the less, it looks like a potential conflict of interest IMO. And the AG office took several months to get back to the area inquiry stating they weren't sure when they would look into this. I would think a statement from the AG office describing the various AG office responsibilities here would have been included in any reply.

At any rate, AG joins the state department of revenue, department of management, Iowa utilities board, local assessors, and numerous public officials in being not helpful with sorting this out so far...

And finally, the BV county and Pocahontas county assessors stating they can't increase wind property taxes unless the utility reports the costs.

I've read numerous department of revenue memos, directing assessors to account for all wind project costs, and I've listed enough examples on this blog to determine that in my opinion, that's not happening , I see nothing in the wind statute that prevents them from tracing down these discrepancies, or increasing property taxes as a result of the re power. Assessors are welcome to go on record here, or provide the specific part of the code that prevents them from doing this. I'll also note that the Calhoun county assessor verbally told me that all county assessors are using the same methods to value wind property as Buena Vista county, as that county had one of the first large wind projects in the state. An email from her stating that all counties are assessing wind properties the same way is posted on this blog .

Wind property is assessed locally, and this is a departure from how assessors treat other property owners who make improvements , and, a clear county and state appeal process exists for property owners who disagree with property assessments. In fact Calhoun county has already handled a contested wind property review, and ruled improperly in my opinion.

So the property tax issues I've been reporting have become an even bigger mess.

stay tuned.

here

Subscribe to:

Posts (Atom)